Georgia’s Business Startup 5 Important Steps | LLC Startup-Georgia

If you are planning to Start up your own business in Georgia, it would be very easy, if you prepare your business formation with the right planning. Entrepreneurship can give you financial freedom. It is very important that business must Follow the secretary of state business guidelines.

Different businesses have their own criteria, for example, alcohol, Barbeque Restaurants, food, lodging, medicines, etc. In this article, I am going to explain the 5 most important steps to help you plan your start-up business in Georgia.

Table of content:

- Business Formation in Georgia | LLC startup in Georgia

- Federal Tax Identification Number in Georgia

- Your EIN Application Requirements | Form SS-4 filling

- Applying (the NAICS code)

- Business tax registration in Georgia

- Business planning

- What is the most important step to set up a business in Georgia

- What are the small business benefits in Georgia

- How much does it cost to get EIN

- How long does a business approval required in Georgia

Business Formation in Georgia | LLC startup in Georgia :

1st step:

Starting your own business in Georgia, the first step would be, you may structure your base business and business formation. Whether you are willing to start up an LLC-Georgia, or sole proprietorship, partnership business, or corporation. As per your business formation type, you may organize your business need to apply by the Govt business approval.

Of course, it is always better to discuss with the Government licensing department and their requirements before starting up a new business. Georgia’s secretary of state is the authorized department where you can get the right information. Get Link Here.

powerlinekey.com,

pixabay.com,

Federal Tax Identification Number in Georgia:

2nd step:

Applying (EIN code ) is one important business permission called Employer Identification number. An Employer Identification Number is also called a Federal Tax Identification Number. It is an entity of your business identity. Here each employee may apply for their own EIN.

This registration is applicable for all types of organizations, different types of organizations have different tax benefits. It is always best to check with your EIN type before registration, by the IRS and SSA (Social Security Administration) department. This is a free service by the Government, you can also apply online, Find the link Here.

EIN Application Requirements | Form SS-4 filling in Georgia:

You’ll be asked to provide the following information when you apply for an EIN:

- Business Owner name and address,

- Business or office Postal address,

- Mailing address,

- Business type,

- Individual taxpayer’s numbers or social security numbers,

- Date of business starts,

- Applying EIN reason,

- Total number of your employees,

- The highest number of employees expected in a year,

- Employees tax liabalities,

- Wages details day base /monthly base /yearly base,

- If you hire any third party to receive EIN,

- Signature,

In the case of foreign nationals, You may require your valid resident permission, for US national social security number is enough.

How much does it cost to get EIN?

However, it is Free and provided by IRS (Internal Revenue Service Department).

Get the link Here:

Applying (the NAICS code) in Georgia | North American Industry Classification System:

3rd step:

It’s a north American Business classification system, which helps provide statistical data and analyze businesses. It is covered by the government of the US, Canada, and Mexican entrepreneurship development purposes. NAICS helps you develop your own business policy.

As per your business classification, you may also get help for your, own business development of valuable data in Georgia. You may check your business or industry classification match, to get the right one: Here,

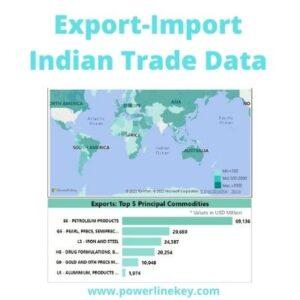

Business tax registration in Georgia:

4th step:

Different Types of business has different types of tax identification in Georgia. It is required to check your business tax type. Here are the most popular tax types, Example:

- Goods or service tax,

- Corporate tax,

- Import tax,

- property tax,

- and personal income tax.

- Corporate Profit Tax,

- Value Added Tax,

- Excise Tax,

- Personal Income Tax,

- Import Tax, and Property Tax.

Personal and income taxes are the top Sources of State Revenue.

Business planning | What is the most important step to set up a business in Georgia:

5thstep:

One of the most crucial steps is analyzing a business plan or step-by-step roadmap including the financial investment plan.

What are the small business benefits in Georgia?

If you have a small business, then you may get tax reduction benefits, including business-related bank fees, start-up business expenses, travel expenses, internet, phone bills, business education expenses, medical expenses, and other office expenses.

How long does a business approval required in Georgia?

It depends on the type of business formation, however, it may take one week time to verify all company liabilities by the department.

Conclusion:

A well-analyzed business plan is required to Start up a business or LLC in Georgia.Organizing

your business-related expenses daily, or monthly basis can help you, End of the day submit easily your own business return.

If you feel this article may help someone start a new business in Georgia, please share it with others. Your Valuable likes, comments, and shares would be appreciated.

Thank You.