Collateral Free Business Loan Apply Online | Micro Small – Medium Enterprises Finance

Collateral-free loan applications become easier to reach for Micro small and medium businesses. It is, of course, a little painful for micro-small businesses because of fewer knowledge outcomes from different govt schemes. Starting up a new business always feels harder. Here is one special access key to the business loan with Govt scheme.

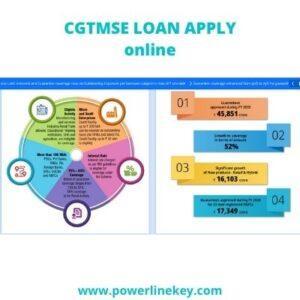

This Msme business loan application also helps new and existing small-scale entrepreneurs today. As per government data during 2023, a report of 1,04,781 crore guarantees was approved. micro and small businesses have benefited from collateral-free bank guarantees, a total cost of Rs. 36,954 crores.

In this article, I will explain in detail how you can apply yourself online for a collateral-free Micro small-scale business loan.

What is a collateral-free business loan for MSME| Small business loan scheme | Sanctioned amount of the credit facility |

Collateral-free business loan examples CGTMSE, Govt of India MSME, and SIDBI are provided for a certain period of term loan bank guarantee to the authorized micro-small businesses in India.

However, bank loan guarantees to cover up to 85%,80%,75%, and 50% paying interest with zero percent, as per different schemes example

- Small business loans for women entrepreneurs,

- Units located in North East Region,

- MSE Retail Trade,

- Micro Enterprises,

- And other small businesses.

What is a CGTMSE loan:

The government of India, MSME has introduced a Credit Guarantee Scheme for micro-level and small-scale businesses across the country. Under the Govt of India, SIDBI is the regulator authority for (CGTMSE) Credit guarantee fund trust micro-small enterprises.

The source of the blog article is the government of India CGTMSE website, MSME, online blogs research, and personal market analysis.

Here all the Govt authorized new and existing micro-small enterprises can apply, for credit guarantee certificates, for collateral-free business loans online.

Here are the essential steps to follow before the CGTMSE loan application:

1. Business formation:

Whether you are a manufacturer or service provider, you may get a business form certification including Gst, your business specialty, brand quality, skills, business administration, or other standard business-related certificates.

2. Business plan and project:

A business plan is the route map to achieve your business goals. Your business project should cover the following:

- Step-by-step business process map,

- Your set market demand,

- your competition of business supply,

- your financial step-by-step plan,

- your backup financial plan,

- your experiences,

- skills,

- your business strategy,

- your business policy,

- what is better in your products or services,

the complete practical market plan should cover your project.

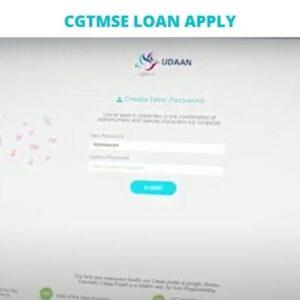

3. Register on Udaan Portal online:

Get verified and apply for a Credit guarantee trust fund under CGTMSE. Fill out all necessary steps and submit the required documents. You will redirect to the authorized bank.

Please follow the following steps: You can also check your eligibility through the eligibility calculator option in the Udaan portal.

How to apply for a micro-small-medium business (MSME) collateral-free loan:

MSME loan application steps are the following | How to get the Udaan Registration certificate and apply steps:

1. To register your business you may submit, submit your mobile number and email id verification through OTP,

2. Create one password for your dashboard login,

3. After login you have the option to choose a new or existing business,

4. You may check and tick that your business is under the micro or small business category,

5. If you have an existing business, then you may submit your GST details and permit API access,

6. In case you have not filed your GST, then you have an additional option to fill the last 12-month sale report here,

7. If you are a new business owner, then you may have to submit your personal ITR return here,

8. You may have to fill out a small form, read the terms and conditions carefully and submit it,

9. After you may check and verify your email id to get a provisional guarantee certificate online,

10. Next step you will get the option to choose your nearest bank, state, etc,

11. In case you have applied to a bank but unfortunately, the bank is not able to provide you collateral-free loan, then you have the option to choose another bank, in your Udaan dashboard.

Query Contact number:

Toll-Free No. : 1800222659/ (022) – 6722 1553

10.00 AM to 06:00 PM

FAQ:

Who can apply for CGTMSE collateral-free loan?

Ans:

All the micro-level and small-level enterprises can apply for a CGTMSE collateral-free loan.

Which businesses are eligible to apply collateral-free loan guarantee:

Ans:

New entrepreneurs and existing entrepreneurs both are eligible to apply for a CGSMSE collateral-free loan.

What is the maximum amount covered under CGTMSE?

Ans:

Micro Enterprises: Upto Rs.5 lakh, the CGTMSE covers 85% amount of Rs.4.25 lakh.

While 5 lakh Rs to 50 lakh Rs.CGTMSE covers 75% of the total amount of Rs.37.50 lakh,

Rs.50 lakh to Rs.2 Cr, the scheme covers 75%, of the total amount of Rs.1.5 Cr.

Check your business Eligibility calculator: Click here

Registration and apply to CGTME(Udaan) online: Click here

Conclusion:

If you are following these steps, Micro, Small enterprises can easily apply for a collateral-free loan guarantee online.

Your small business step-by-step plan, business demand, the value of service, business project preparation, and business experiences are the major factor in any loan funding.

If you have any complaints against the bank, here you can register a complaint Read here.

Also, read MSME related article:

MSME Registration Free | Benefits | Udyam online Apply Steps: Read here

- Our recommended Business development software and tools affiliate links: Get here

- On-demand skill development: Get here

- Start earning money: Start here

Your valuable share would be appreciated by Powerlinekey. com,

Thank You.